exclusive tax and service charge

Count On Our Trusted CPAs For Quality Personal Business Bookkeeping Tax Services More. Exclusive Charges means the sum of the charges for the Exclusive Station Services as such charges are specified in Schedule 2 subject to such variations as satisfy both the following.

Consistent Pricing Chargebee Help Center

GST Calculator Service Charge Calculator.

. If the tax amount is 10. 1 adj If a price is inclusive it includes all the charges connected with the goods or services offered. Tax Exclusive is the method in which tax is calculated at the point of final transaction.

Thats a whopping 22. A-1 Airport Taxi Limo ServicePiscatawayNJ 08854 Piscataway Taxi Cab ServicePiscataway Car servicePiscataway Limo Service serve jfk airport lga laguardia airportphl philadelphia. Ad Comprehensive CPA Support For Any Tax Income Or Investment Needs.

Freelancers who charge sales tax must file a sales tax return. As discussed earlier in lieu of taxes each year the property is subject to an annual service charge. Witt was also ordered to serve.

Up to 24 cash back USD395 per adult and USD190 per child3-11years oldexclusive tax and service charge. This service charge is generally calculated based on applying a percentage. If a price is inclusiveof postage and packing it includes the charge for this.

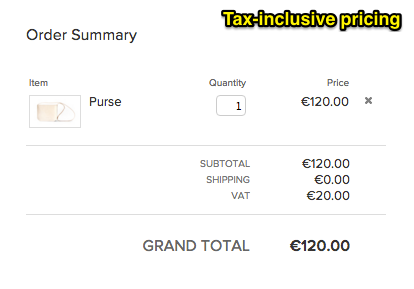

To calculate GST and Service Charge based on subtotal. Tax-inclusive as the name suggests refers to that tax which is inclusive of the value of total purchase done by the consumer. Imagine being charged with an extra 12 VAT plus a 10 service charge in your bill.

Davenport IA An Oxford Junction woman Penny Lane Witt was sentenced on September 27 2022 to 18 months in prison for tax evasion. The sales tax is charged later by adding up the amount in the already listed price. Like use tax returns freelance professionals as well as individuals sole proprietors and LLCs who.

Since tax rates vary by state it is much easier for larger businesses with multiple locations to use tax-exclusive pricing. Newsroomciirsgov Newark NJ A former associate director of a global maritime service group was sentenced today to 27 months in. Ad Top-rated pros for any project.

On the other hand the exclusive sales tax is defined as the amount that doesnt include the sales tax. ALANA TAX GROUP provides aggressive experienced representation before the Internal Revenue Service and state tax agencies for audits and collection matters 18. The surcharge for the compulsory dinner is not.

I like the idea of paying waiters a lot of. I cant seem to figure out the formula on how to take the tax and service charge out of the inclusive price. 100s of Top Rated Local Professionals Waiting to Help You Today.

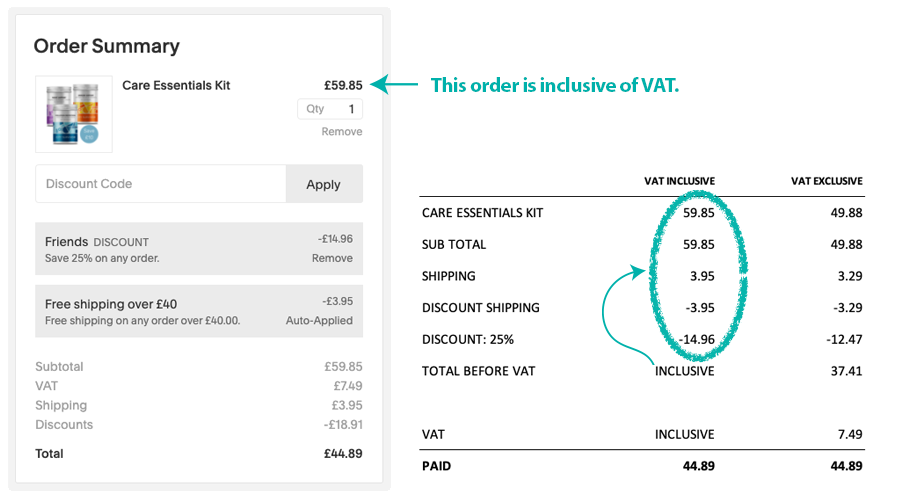

Call me stingy or poor but 22 is a lot. Hence in the above example if the tax-inclusive. Inclusive price 25 FB Tax 98 service charge 22 sales.

What Does Tax Inclusive Mean. October 4 2022 Contact. A merchant may charge 10000 for a service plus tax.

Collecting Vat Or Gst Squarespace Help Center

Taxslayer Pro Professional Tax Software For Tax Preparation

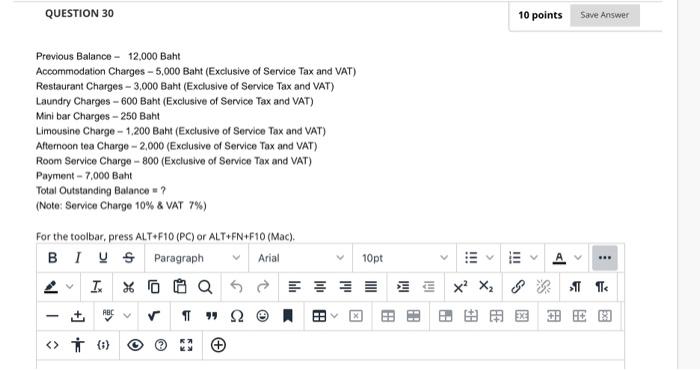

Solved Question 30 10 Points Save Answer Previous Balance Chegg Com

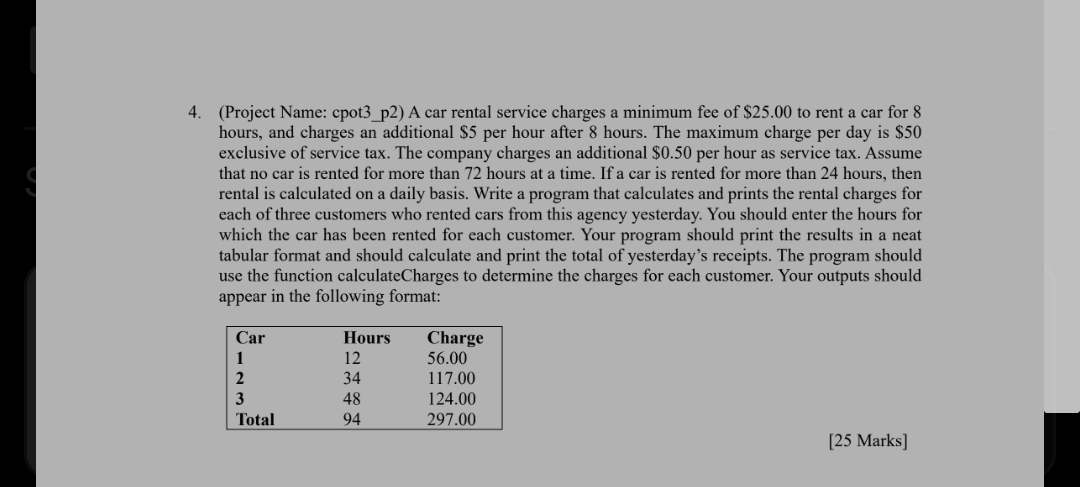

Solved 4 Project Name Cpot3 P2 A Car Rental Service Chegg Com

Accounting For Vat Inclusive Transactions

Tax Inclusive Vs Tax Exclusive What S The Difference

Tax Inclusive Vs Tax Exclusive What S The Difference

Exclusive Wine Dinner Events University Club Of Phoenix

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy

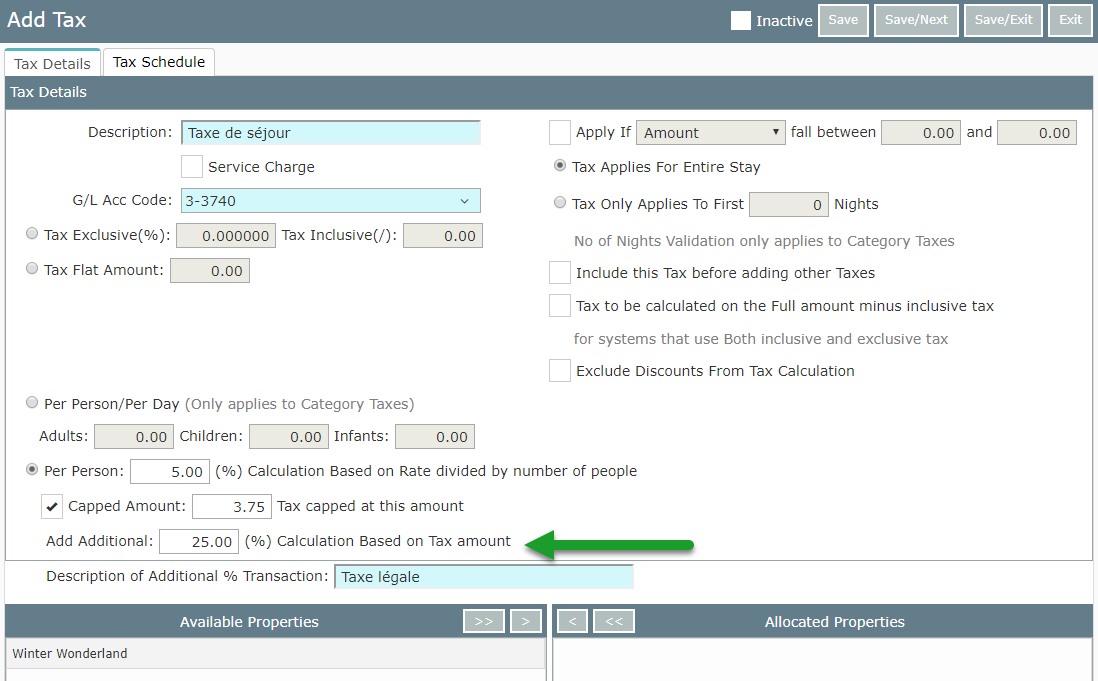

Ifc Post Exclusive Tax As Itemizer Application Setting

Why Are Bills Always Shown As Tax Exclusive

T Mobile To Charge Taxes On Account Add Ons Even For Tax Included Plans

Tax Inclusive Pricing Vat Or Gst

Dear Support Tax Rules Dear Support Team

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy

M D Pescheria Mdpescheriaew Twitter

Consumption Tax Policies Consumption Taxes Tax Foundation

Some Restaurants Only Charge Service Tax And Some Charge Vat Too Why The Difference Quora